Above Average People. First World Problems.

Upset man opening his empty wallet by Sewupari Studio

By Shawn B

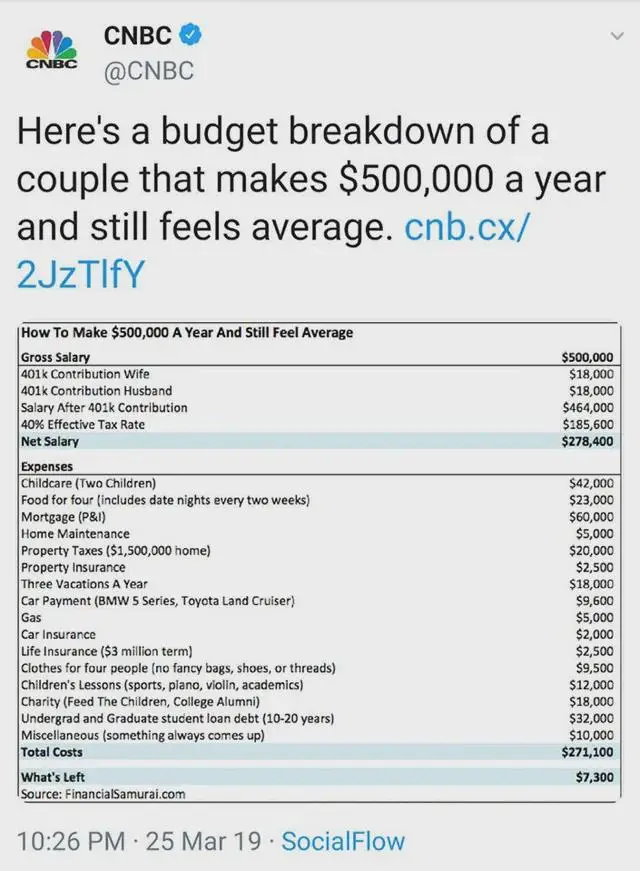

I stumbled across an image the other day – of a couple’s budget circa 2018/19. After a cursory Google search, I found a corresponding article on CNBC. This was of a couple who was complaining about feeling average even though they earn half a million dollars gross per annum. Take a look below.

In a nutshell, we have an above average earning couple complaining about feeling poor despite making $500,000 per year. I’m reluctant to believe this at face value because it seems quite an outlandish claim, simplified in nature, while simultaneously feeling very plausible. Since we live in a land of 330 million, I’ll err cautiously on the belief there is some truth to it.

My first question to this couple is “what is poor?”

According to the Department of Health and Human Services (HHS), in 2019, the poverty guideline for a family of 4 was $25,750 and $43,430 for a family of 8. This couple earns 19.4 times what a poor family of 4 earns and 11.5 times what a poor family of 8 earns. By HHS standards, this couple is clearly not poor, but we all know that. The issue is not that they are poor, but that they feel poor, and the issue with that issue is that it’s an internal problem.

Unfortunately, more than 50% of Americans earning six figure incomes say they’re living paycheck to paycheck. But it’s not the money that’s the problem, it’s a phenomenon called “Lifestyle Inflation” or “Lifestyle Creep”. They, like many high earners, adjusted their lifestyle up to their income limit, hence why they feel average. Even if they made a million a year, they would still likely feel average, because they would also likely have adjusted their expenses to their new salary of $1 million. In other words, It’s not the income or expenditure – it’s the people – and they’ll never feel above water because they keep ramping up the spending as their income ramps up.

I’m glad, however, that they are actually using a budget, and even more enthusiastic that the first line item on their budget is saving in a tax advantaged account. They’re maxing out their 401K, and that’s pretty good. So lets look at their budget and see what actions they can take to rein in their desperation.

40% Effective Tax Rate

Hire a CPA and fire TurboTax/H&R Block. I would hope they aren’t doing their taxes on their own, but if they are, that a grave error – especially at this high income threshold. They need to optimize their taxes. Their estimate says 40%, and the highest tax bracket is indeed ~40%, but taxes aren’t applied simplistically like that. Applied basically, they’re closer to 36% than 40%, and a good CPA could probably get them down to about 31% effective rate. That’s a saving of $41,760 – coincidentally, about an entire year’s salary for the same family of 8 above.

Food for four (includes date nights every two weeks)

This is undoubtedly a high food bill. Not sure what they’re buying here, but if date night is any indication, then they’re probably eating out a lot, or buying too many pre-cooked meals. Either way, both need to be scaled back. Cut date night down to once per month (or go to cheaper restaurants); buy regular groceries and cook more; if they really must, go supplement their grocery shopping with food pantries. They can cut this budget by about $10,000.

Three Vacations A Year

This a luxury item they do not need. Yes, they are making money, and they should enjoy it, but $18,000 is a lot to spend on three vacations. I don’t recommend not taking vacations, but I do recommend they choose cheaper vacations, like camping or cruises. Additionally, they can take advantage of promotions and mileage earned on airfare and hotels in order to offset some inevitable costs. With cheaper vacations and maybe taking only two instead of three, they can probably cut this line item by $10,000.

Car Payment (BMW 5 Series, Toyota Land Cruiser)

This one may seem counterproductive, but they make enough to get rid of the entire car payment bill of $9,600. First of all, they should limit their car budget to no more than 10% of gross for both cars combined. More importantly, they should pay cash for both and skip this annual bill altogether. They can accomplish this by using a portion of their first-year savings to buy both cars outright. It might seem like a big trade off, but if they do this, they can literally both change their cars every 5 years and still have no monthly payments – in perpetuity.

Undergraduate and Graduate Student Loan Debt (10-20 years)

They are high earners, so this is a tough one, but not impossible. They can attempt to reduce their monthly student loan burden by enrolling in one of the many pay-driven student loan plan. This can lower their payment by as much as 50% – a $16,000 savings. Sure, they won’t pay it off in 10 years, but if it’s a federal loan, then after 10 years, they’ll be eligible to apply for forgiveness anyway – as long as they’ve made 120 payments and are in public service.

They should also kill that miscellaneous line item and address these issues as they come up. Put the 10k back in the budget and use it for something more useful – like investments. With their $7,300 surplus, the $10,000 miscellaneous and all the other savings, they’re looking on a total $104,660 per year! They should take $50,000 and pay cash for two cars, which would leave them with $54,660 on year one, then the full amount on years 2,3,4 and so on. They can slowly ramp their fun activities back up once they learn self-control and build lasting good habits.

Other considerations

Now, another thing that’s completely missing from this couple’s finances is their retirement plan. If they want to maintain their current spending in retirement, they are grossly behind the power curve – despite saving $36,000 per year in their 401K. When they retire, they’ll get rid of all of the child expenses, and a few other big ticket items. I estimate they’ll need the equivalent of about $180,000 per year to maintain the same lifestyle. At their current savings rate (including estimated social security benefits), they will be short around $2,732,779 in retirement funds. To meet this target, they will have to double their savings rate from about $3,000 per month to $5,985 per month, which is totally doable since they have an extra $100k to work with. If they want to leave a decent inheritance for the kids, they should up the ante even more.

Conclusion

These people aren’t average and they certainly aren’t poor. Right now they’re being stupid with their money. It’s an easy fix – they have wiggle room in their budget and decent time ’til retirement, but they just need to get out of their own way, learn some discipline and get it done.

Original article: https://www.cnbc.com/2018/03/06/budget-breakdown-of-a-couple-that-makes-500000-a-year-but-cant-save.html